does wyoming have sales tax on food

The state sales tax rate in Wyoming is 4 and there are some places in the state where that is the only rate that applies. Unlike most states Wyoming residents can sell ANY kind of food as long as it does not contain meat and some meat and.

Lunch Buffet Prices Throughout The Week Are Around 16 Plus Tax While Dinner Prices Tend To Be Around 17 Prices Inclu Lunch Buffet Non Alcoholic Drinks Lunch

Restaurants In Erie County Lawsuit.

. See the publications section for more information. Counties are able to add their own local sales tax to this state rate however and this can come in the form of an economic development county option tax a general purpose county option tax or a. Employers pay payroll tax on any salaries they pay to.

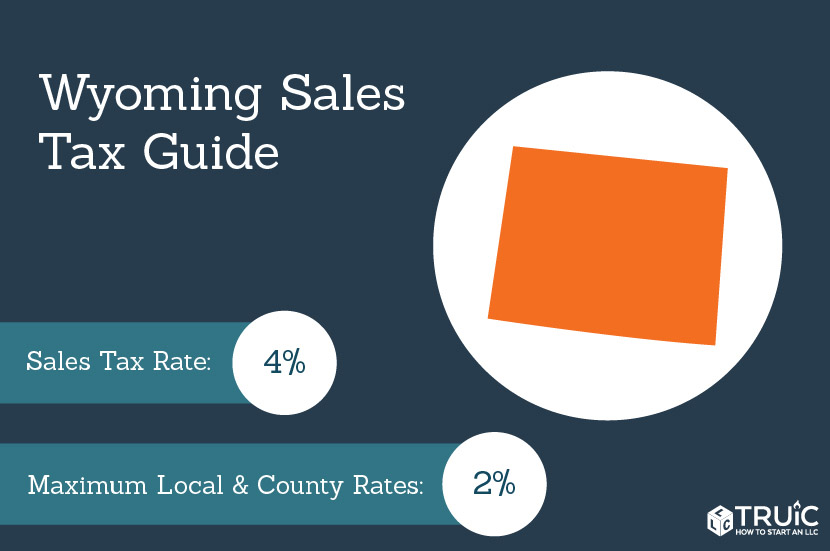

California 1 Utah 125 and Virginia 1. State wide sales tax is 4. This page describes the taxability of food and meals in Wyoming including catering and grocery food.

Owners pay self-employment tax on business profits. But as budget cuts wont solve the crisis the state may need to consider tax increases. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2.

But the measure wasnt created to fill the hole dug by. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. Wyoming Repeals Sales Tax on Food.

Owners pay federal income tax on any profits minus federal allowances or deductions. Heres an example of what this scenario looks like. While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation.

Groceries and prescription drugs are exempt from the Wyoming sales tax. This includes Wyomings sales tax rate of 400 and Laramie Countys sales tax rate of 200. Sales Use Tax Rate Charts.

We include these in their state sales tax. Does Wyoming Have Sales Tax On Food. According to House Bill 169 raising the state sales and use tax rate from 4 to 5 could generate between 138 and 142 million for the state annually and approximately 63 million for localities.

Tax rate charts are only updated as changes in rates occur. Only five states dont impose a sales tax but many exempt food drugs and even clothing to make up for it. Are Dental Implants Tax Deductible In Ireland.

Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4. If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area.

As Wyoming residents stocked up on food for their 4th of July celebrations few noticed the lower sales tax charge at the checkout stand. Only five states dont impose a sales tax but many exempt food drugs and even clothing to make up for it. Natrona County Representative Ann Robinson D-rep joined her.

Wyoming has 167 special sales tax jurisdictions with local sales taxes in. Today over the Tax Foundations Tax Policy Blog we get a little taste of how fun defining something like food can be. Opry Mills Breakfast Restaurants.

Does Wyoming Have Sales Tax On Food. 53 rows a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. Ann Robinson D-Casper spent eight years bringing bill after bill to the Wyoming House before finally seeing the food tax exemption pass as a state budget amendment.

In Wyoming certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. State State General Sales Tax Grocery Treatment. Some LLCs pay Wyoming sales tax on products.

Delaware doesnt have a sales tax but it does impose a gross receipts tax on businesses. We advise you to check out the Wyoming Department of Revenue Tax Rate for 2020 PDF which has the current rates. Instead taxes are as follows.

Restaurants In Matthews Nc That Deliver. This page discusses various sales tax exemptions in Wyoming. There are several exemptions to the state sales.

Are Dental Implants Tax Deductible In Ireland. A lot of blood sweat and years went into the fight to remove state sales taxes from groceries in Wyoming. Delawares gross receipts tax is a percentage of total receipts from goods sold and services rendered within the state and it ranges from 0.

Wyoming Sales Tax Rates. Wyoming has the best cottage food and food freedom law in the United States. The Excise Division is comprised of two functional sections.

Mary owns and manages a bookstore in Cheyenne Wyoming. The Wyoming state sales tax rate is 4 and the. Wyoming is one of the 37 states that partially or wholly.

While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. As of July 1 Wyoming residents no longer must pay sales tax on food that they prepare before eaten. The state sales tax rate in Wyoming is 4000.

Now if youre like some people we know there is lots of stuff at the grocery that definitely should not be consumed by human beings but in order to avoid raucous debate it gets the food label. To learn more see a full list of taxable and tax-exempt items in Wyoming. Majestic Life Church Service Times.

Currently combined sales tax rates in Wyoming range from 4 to 6 depending. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. Sales Tax Exemptions in Wyoming.

B Three states levy mandatory statewide local add-on sales taxes. Since books are taxable in the state of Wyoming Mary charges her customers a flat-rate sales tax of 600 on all sales. It finally happened in 2006.

Wyoming Use Tax and You. It finally happened in 2006. In addition Local and optional taxes can be assessed if approved by a vote of the citizens.

The Wyoming legislature adjourned earlier this month after approving a 34 billion budget and removing the sales tax on food for the next two yearsThe state is enjoying a budget surplus and legislators debated various tax relief plans including proposals to increase tax refunds to the elderly and disabled lower the sales tax cut the property tax repeal the sales tax on both food. They passed the Wyoming Food Freedom Act in 2015 HB 56 making them the first state to eliminate most regulations on local homemade food sales.

Here Are Just A Few Of The Many Reasons To Live In Wyoming

Wyoming Sales Tax Small Business Guide Truic

Wyoming Sales Tax Rates By City County 2022

Heart Mountain Between Cody And Powell Wyoming Spectacular Wyoming Vacation Cody Wyoming Wyoming Travel

Fun Free Things To Do Near Me With Kids Archives Usa Map United States Map Territories Of The United States

Free Hotel Food Beverage Manager Cover Letter Template Google Docs Word Apple Pages Template Net Lettering Cover Letter Template Free Cover Letter Template

How Wyoming Became A Top Tax Haven With Its Cowboy Cocktail

The Spagetti Machine Pancho S Mexican Buffet New Mexico Albuquerque News

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

What Do Wyoming S 13 New Blockchain Laws Mean

Pin On 2012 06 Sanford S Pub Grub Casper Wyoming

New Wyoming Law Lets Local Ranchers Sell Cuts Of Meat Directly To Consumers

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

Northern Wyoming Road Trip The Top Things To Do Where To Stay What To Eat Loveexploring Com Wyoming Travel Road Trips Wyoming Blockchain

Do I Need A Business License For A Home Or Online Business Ct Online Business Business Starting A Business

Wyoming Fashions Itself As Tax Haven For World S Rich Report

Wyoming Income Tax Calculator Smartasset

Want To Avoid High Taxes Retire In One Of These 10 States Retirement Tax States

University Of Wyoming Proposes Sweeping Academic Reorganization Including Staff And Tenured Faculty Cuts