tax act stimulus check error

Of note the IRS is also using information from this seasons returns to process the new 1400 stimulus checks or potentially top up those payments. Hell have to wait to pick up.

Stimulus Check Payments Nursing Home Residents Center For Elder Law Justice

Then the software computes the amount of your.

. But the IRS states. We filed with Tax Act and had our fees taken out of our return. Jackson Hewitt released the following statement.

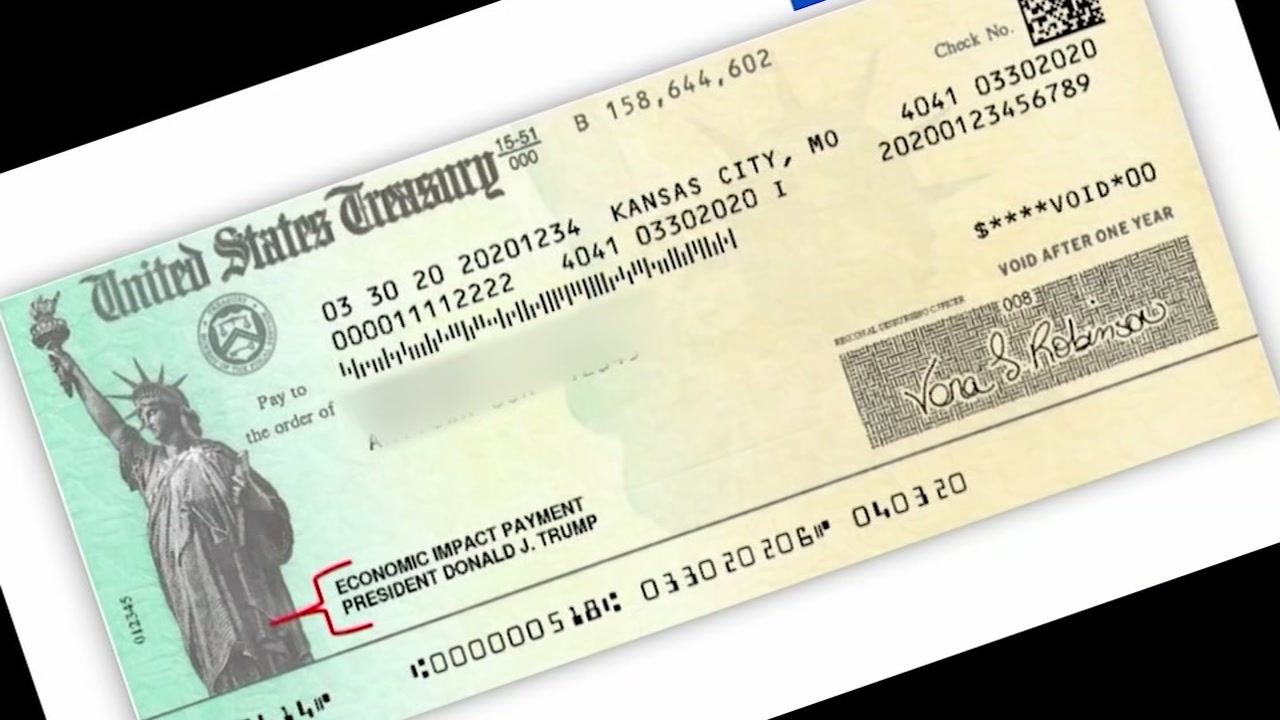

The Consolidated Appropriations Act 2021 added additional funds to this credit which basically serves as a second stimulus payment for most taxpayers. A similar glitch plagued 13 million taxpayers in January when the Internal Revenue Service initially sent their 600 checks to pass-through bank accounts that tax-prep companies. A check was issued in the name of a single deceased person - the check was sent in error.

If correct check the box. Id be more concerned about the child tax credit he missed out on than the EIPan amended return wont complete processing for 6 months or probably more. This year individual tax.

Follow the directions from the IRS on how to claim these payments if you were eligible for but did not receive them or if. Upon realization of this error the IRS instructed. We use chase for our bank.

The Recovery Rebate Credit was added for 2020 as part of the CARES Act to reconcile your Economic Impact stimulus payment on your 2020 tax return. What to Do If You Didnt Receive Your Stimulus Checks. Stimulus payments erroneously sent to closed or incorrect bank accounts by the IRS.

If you suspect an error you should report this to the IRS at 800-829-1040 and take steps to resolve this. Securely access your individual IRS account online to view the total of your first second and third Economic Impact Payment amounts under the. If you do NOT check the box no bank account information will be sent and you will receive your stimulus payment as a check from the IRS.

The IRS issued a stimulus payment based on the 2018 tax return information - that payment is an error. You are supposed to pay it back. DALLAS CBSDFWCOM - After the IRS sent millions of stimulus payments to the wrong bank accounts tax preparation companies.

If you received the full amount you. You gave up US citizenship or renounced a green card in 2019. This IRS error caused some people to not.

The IRS sent some of the stimulus payments to inactive or closed bank accounts. Disaster Tax Relief box is automatically checked and I can not uncheck it. I opted for the deluxe edition e-file for HR block I think it was 2999 plus 3999 to have the cost.

Your Online Account. If you are unable to resolve your issues with the IRS and are eligible for direct assistance generally you are one of the taxpayers identified in 1-7 above and you meet TAS. If you make a mistake on the Line 30 amount the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to your tax.

Stimulus payments for millions of TurboTax customers affected by the IRS error will be. The TurboTax software adds together the entries that you made for receiving stimulus check 1 and stimulus check 2. So I just filed my taxes online for free via tax act which IRSgov sent me to and one of the questions was did you receive a third stimulus for 1400 for a moment I was confused and.

Stimulus payments erroneously sent to closed or incorrect bank accounts by the IRS are being redirected according to tax preparation companies affected by the mistake. However there is also a chance that you miscalculated how much money. The IRS and tax industry partners are taking immediate steps to redirect stimulus payments to the correct account for those affected the IRS said in a statement adding.

10 2021 we announced the IRS has committed to reprocessing stimulus payments directly to our customers impacted by the IRS payment error. Yes if your 2020 has been processed and you didnt claim the credit on your original 2020 tax return you must file an Amended US. However for many Americans who used online tax services it may be too late to receive an advance 600 stimulus payment.

Transcript says 14 and the check my payment or whatever its called shows status not. January 11 2021 1004 AM CBS DFW. Delete state return if you have one.

On the screen titled Verify that your bank account information is correct double check your bank account information entries. Individual Income Tax Return Form.

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc7 Chicago

Coronavirus Stimulus Checks Sent To Millions Of Dead People Treasury Department Wants Them Back Abc7 San Francisco

The Second Stimulus Payment Is Happening Taxact Blog

Your Stimulus Check May Not Come Until 2021 The Washington Post

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York

Rejected Return Due To Stimulus H R Block

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

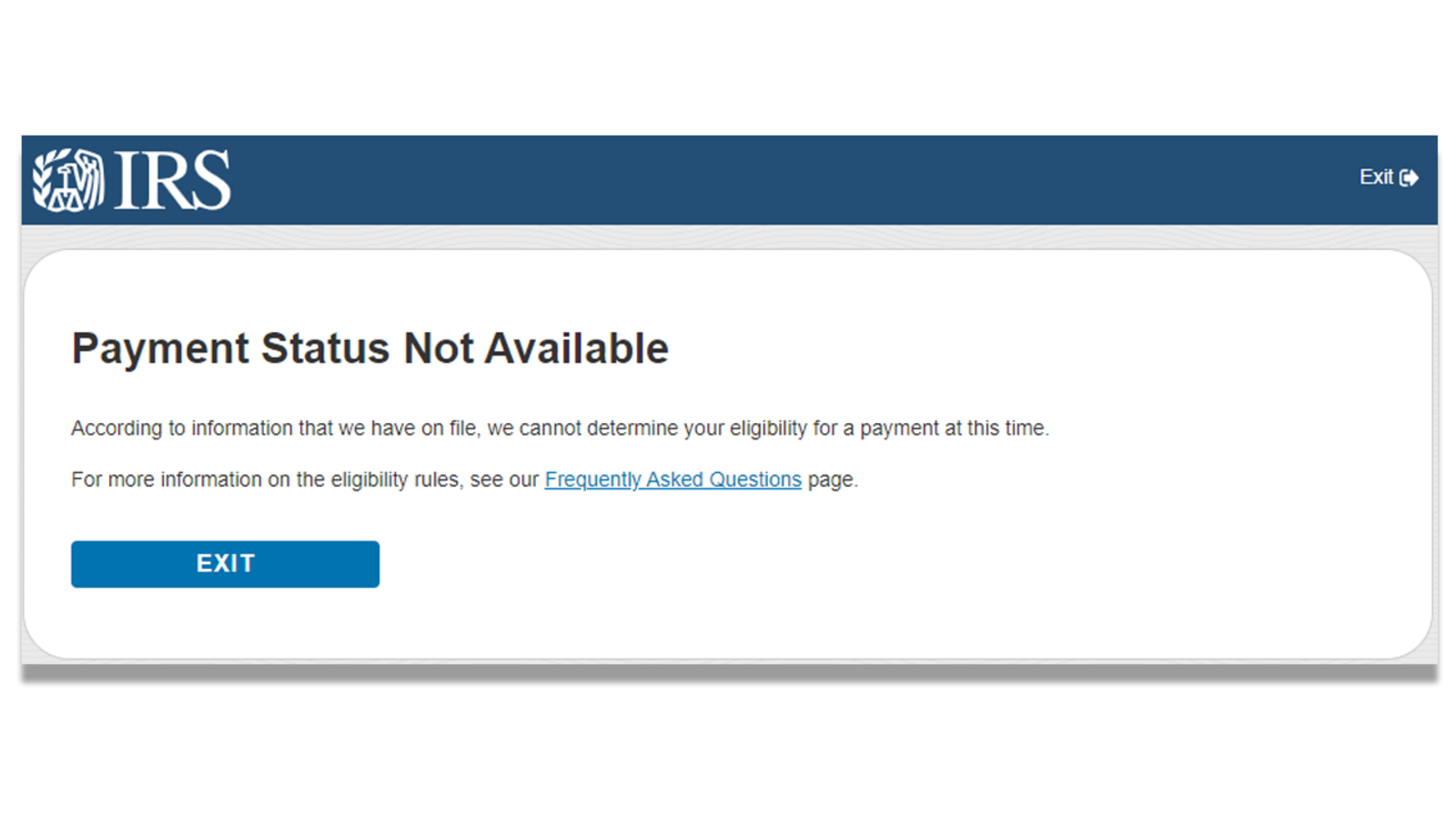

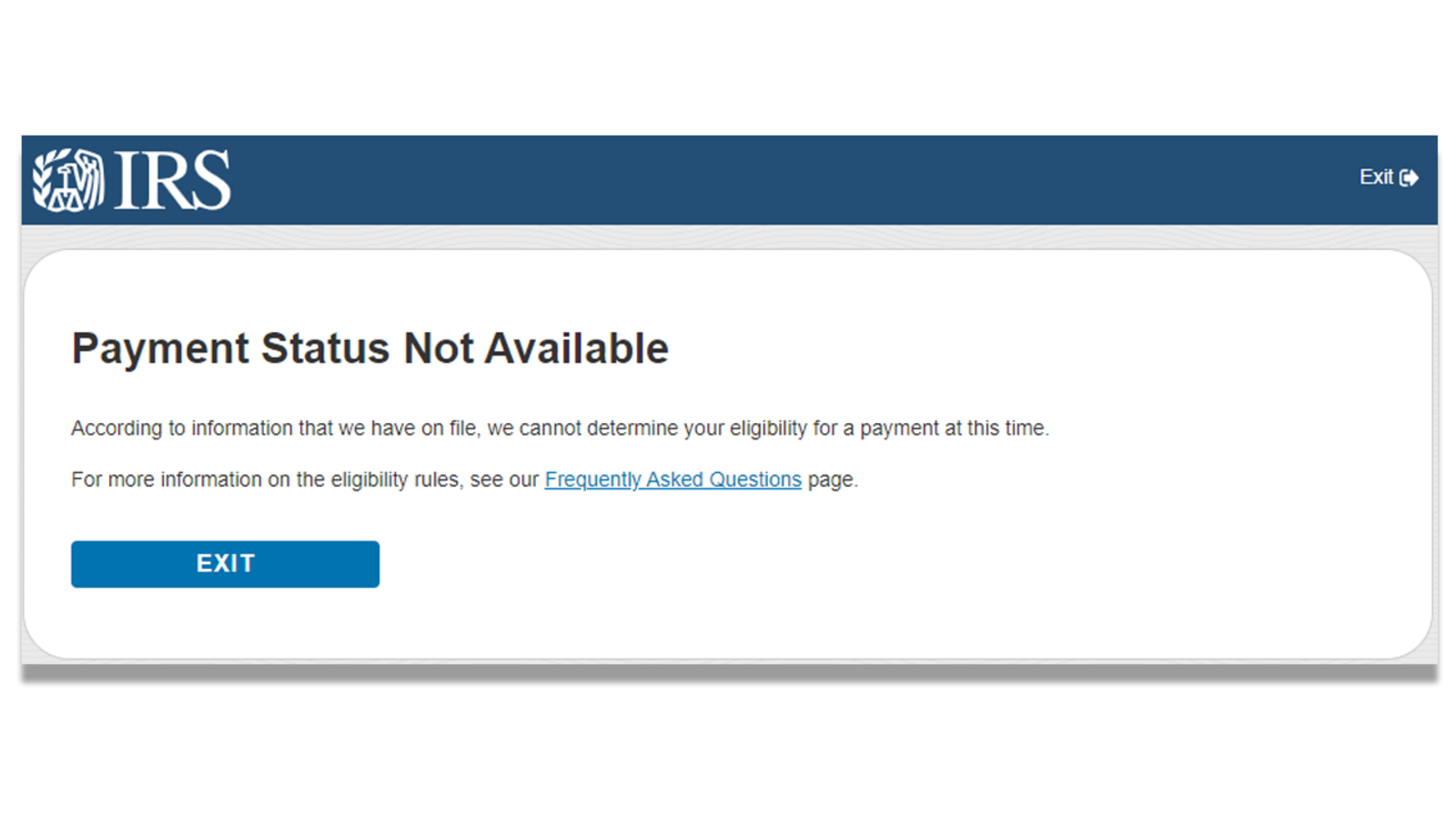

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc11 Raleigh Durham

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

Stimulus Checks You Have Questions We Have Answers Kare11 Com

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Americans Struggle To Receive Missing Stimulus Checks

Where S My Third Stimulus Check Turbotax Tax Tips Videos

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham

Third Stimulus Check Update How To Track 1 400 Payment Status 11alive Com

Irs Sent Second Stimulus Payments To Wrong Bank Accounts The Washington Post